Once you have an up-to-date prescription, most sites should let you use your FSA to pay for your new contacts or specs, including hip spots like Warby Parker and See Eyewear.

Prescription glasses, contacts and eye care: If you’re due for an eye exam, you can now do those online (and can probably also pay for that with your FSA).

#Fsa eligible expenses 2021 crack

Have you signed up for our newsletter on earthquake preparedness? There’s a whole section on what to have on hand in case of emergencies.) If you already have a kit that you’ve had an occasion to crack open, your FSA can cover things like bandages and first-aid ointment to replenish it. Once you’ve got them, here’s what you should know about how, when and why to use them ahead of Thanksgiving, Hanukkah, Christmas or other holiday gatherings.įirst-aid kits: You should have one for your home and one in your car. Here’s howĪdd some rapid COVID-19 tests to your holiday shopping list. Lifestyle At-home COVID tests could make holiday reunions with family safer. Here are some of the items you might not have realized were FSA-eligible, in case you need shopping inspiration: There’s also, which - as you might have guessed from the name - only sells FSA-eligible things. Lots of sites have a page dedicated to covered supplies, including Amazon, Target, Costco, CVS, Rite-Aid, Walgreens and Wal-Mart.

You can also use your card to buy eligible items online. Swipe your FSA card first at checkout and payment for all eligible items (see below for ideas on those) will go through. Pharmacies like CVS and Rite-Aid allow you to use your FSA card just like a debit card.

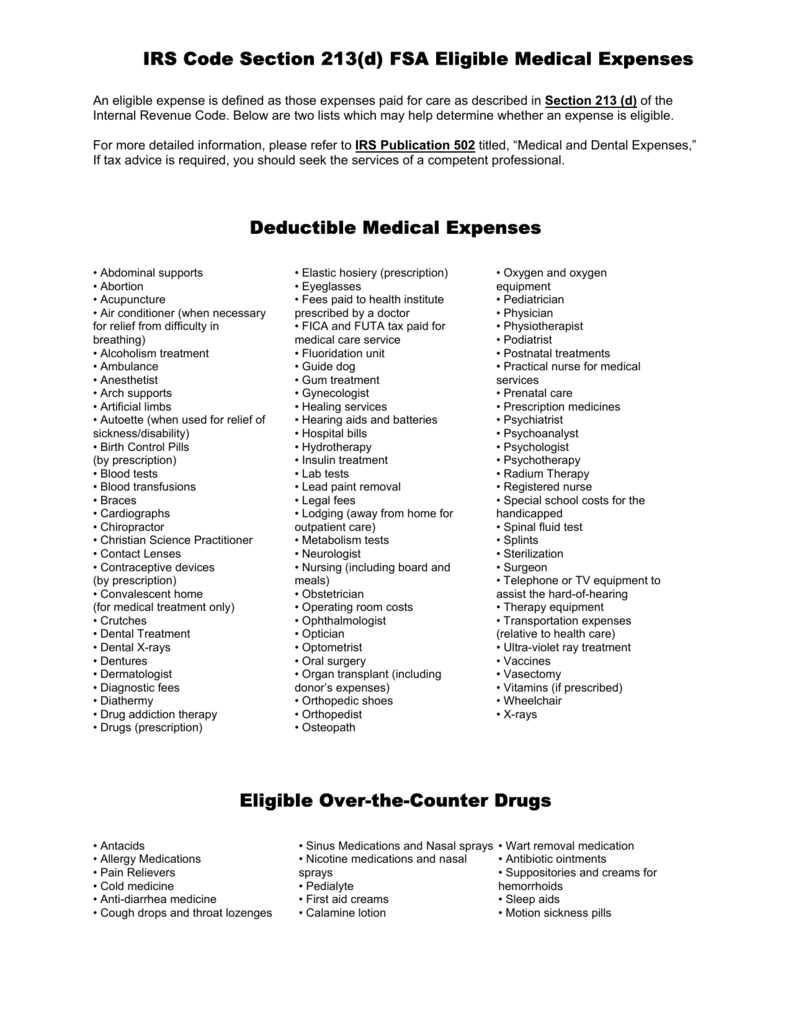

If they aren’t, there are lots of ways to use up your FSA balance. Contact your benefits provider or human resources department and ask whether your employer is participating. If your workplace opted in, you may be able to roll over the entirety of your remaining balance to 2022. Congress changed the rules for 20 under the assumption that some people may have skipped or delayed healthcare visits on account of the pandemic. Workers who forget wind up forfeiting an estimated $400 million a year collectively.īut this year, things are different. (The current legal limit is $550, though your plan might have a lower limit.) If you didn’t end up having many medical bills that year, December sometimes winds up being a hustle to spend the rest. Most years, you can only roll over some of that balance to the following year. The maximum amount you could set aside for an FSA in 2021 was $2,750. If you have one of those, the balance can be rolled over to the next year.) (An FSA is different from a health savings account, or HSA. That includes doctor’s bills, co-pays and prescriptions - as well as a lot of over-the-counter medications and other health-adjacent products and equipment. The accounts, known as FSAs, allow you to set aside pre-tax income to spend on qualified medical purchases. Is your healthcare flexible spending account balance burning a hole in your pocket? Don’t rush to spend it just yet.

0 kommentar(er)

0 kommentar(er)